Development fund for Indian economy’s Victory Over Corona in 2020

Development fund for Indian economy’s Victory

Over Corona in 2020

A potential solution to revive Indian economy

from COVID 19 set back

The Background

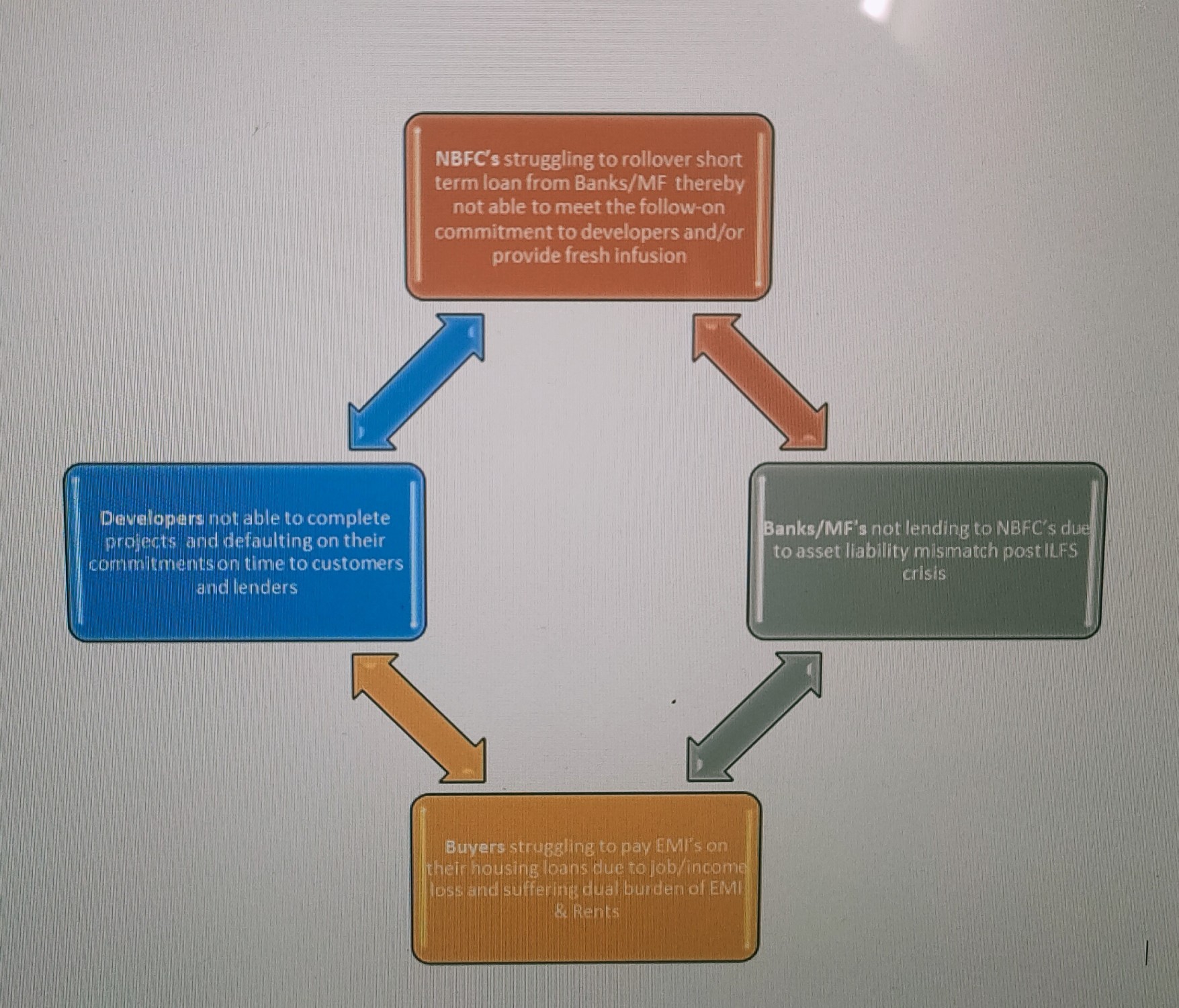

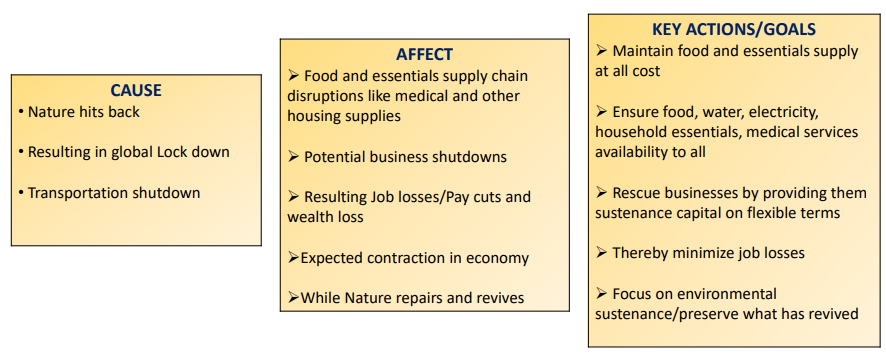

Covid 19 outbreak has resulted in Global and National calamity. In India almost 70% of economic activity has come to a stand still threatening the survival of businesses that can potentially result in huge job losses/pay cuts and corresponding loss of significant revenue to the government that is supposed to be used for various economic and social welfare schemes. This kind of adverse economic situation has not been witnessed by us in our lifetime.

History has proven that mankind has emerged stronger and more connected after such setbacks over last 100’s of years. This shall also pass In times of such crisis, it is important that, Countrymen and Business houses that are better off and sitting on liquidity should come forward and contribute towards economic revival NOT as a ‘Donation’ but as an ‘INVESTMENT’ that can yield good returns for them while it rescues the economy and helps it tide through these testing times The subsequent slides provide the underlying principals on which the fund should be raised, invested and returned/safeguarded, while it creates a huge impetus for the economy without depending on any external help

COVID 19 DISTANCED US, THE ABOVE ACT WILL REUNITE US

Year 2020 – The COVID 19 Impact

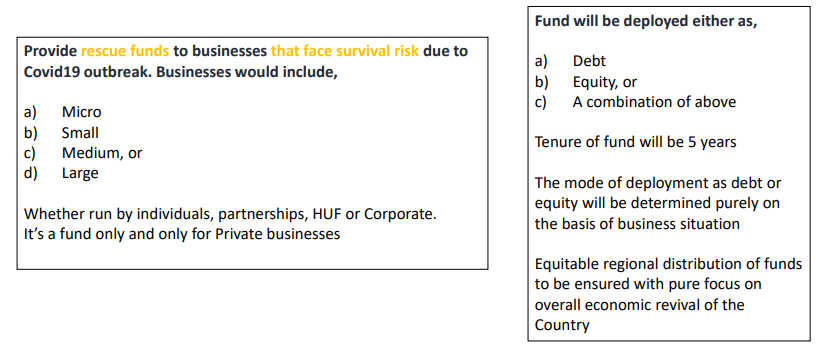

Key Objectives of the Fund

Contributors to the fund

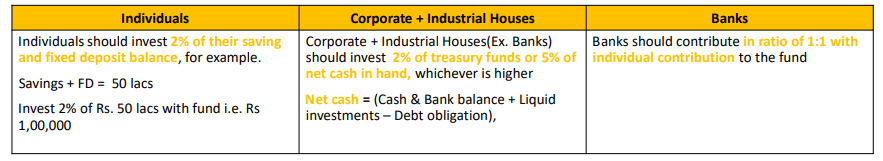

Who should Invest?

a) Individuals with enough liquid funds in their saving balance, fixed deposits , debt and mutual funds. Target segment is top 1 crore individual taxpayers of the country

b) Corporate/Industrial houses with

i. Large treasury balances and/or good debt cover,

ii. Include their CSR contribution

c) Banks in proportion of additional liquidity released to the banks by RBI should mandatorily invested in this fund` Individuals Corporate + Industrial Houses Banks Individuals should invest 2% of their saving and fixed deposit balance, for example.

Savings + FD = 50 lacs Invest 2% of Rs. 50 lacs with fund i.e. Rs 1,00,000 Corporate + Industrial Houses(Ex. Banks) should invest 2% of treasury funds or 5% of

net cash in hand, whichever is higher Net cash = (Cash & Bank balance + Liquid

investments – Debt obligation),Banks should contribute in ratio of 1:1 with individual contribution to the fund.

How much should one invest?

- If top 1,00,00,0000 individual taxpayers can INVEST average INR 2,00,000.

- INR 2,00,000 crores can be raised only from individuals and

- Equivalent amount of INR 2,00,000 crs invested by banks

- This methodology can generate a rescue fund of almost INR 6,00,000 – 8,00,000 crores and it will serve 2 key purposes,

-

a. Its an investment with a good return guaranteed by government and not a mere tax hit imposed that impacts the individuals

adversely - b. Funds will be used for revival and growth of businesses thereby driving consumption, save jobs and keep government tax revenues moving

- Additional voluntary contributions may be allowed

Return proposition for Investor

The fund will carry following commercial terms,

a) Tenure of investment – 5 years

b) 6% per annum fixed return on investment , payable quarterly

c) 1% per annum accumulated return to be paid along with principle invested at the time of maturity, subject to fund generating enough returns

d) Principle to be returned at the end of year 5 and carry a call option after which can be exercised by the Fund anytime after 2 years in one go or in parts

e) 0% TDS on interest payout

f) Government of India to provide sovereign guarantee for any shortfall through 100% tax credited

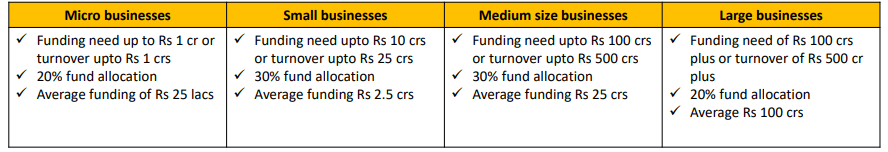

How the fund should operate?

• It should be a Special Situation Fund set up by center (AIF)

• Minimum contribution of Rs 1,00,000 should be permitted

• Following allocation matrix may be followed

Fund should invite online application and proposal from various segments across the country. Industry level matrices based initial assessment screens should be developed for filtering proposals. NPA and stressed a/cs should also be considered

Central governance team of senior retired bankers, fund managers both public and private should be established and similarly teams at each state shall be setup to facilitate

Diligence and disbursement process to be made as faceless as possible

Fund management team will be eligible for 1% per annum management fees to manage the fund

Fund will be deployed as debt, equity, mix of debt or equity depending on the requirement of the businesses

Fund Target to generate average 10 % per annum returns

Suitable principal moratorium should be provided to ensure business revival

Listing of fund units over stock exchanges should be valuated to ensure greater liquidity

Investor Capital Protection Terms

Considering the fund can have high delinquency, say up to 20-25% due to current

opaqueness on how future will shape up, it is proposed that Investor’s principal

contribution and returns shall be guaranteed

In case funds fall short off the prescribed return plus capital to be returned at the

end of 5 years, the difference should be adjusted in income tax liability of the

contributor till it is fully recovered along with interest of 6 percent per annum

Investor Capital Protection Terms

The above proposal and act of solidarity by our countrymen will help us tide these

tough times and we will come out bigger, better and will achieve inclusive prosperity

in future